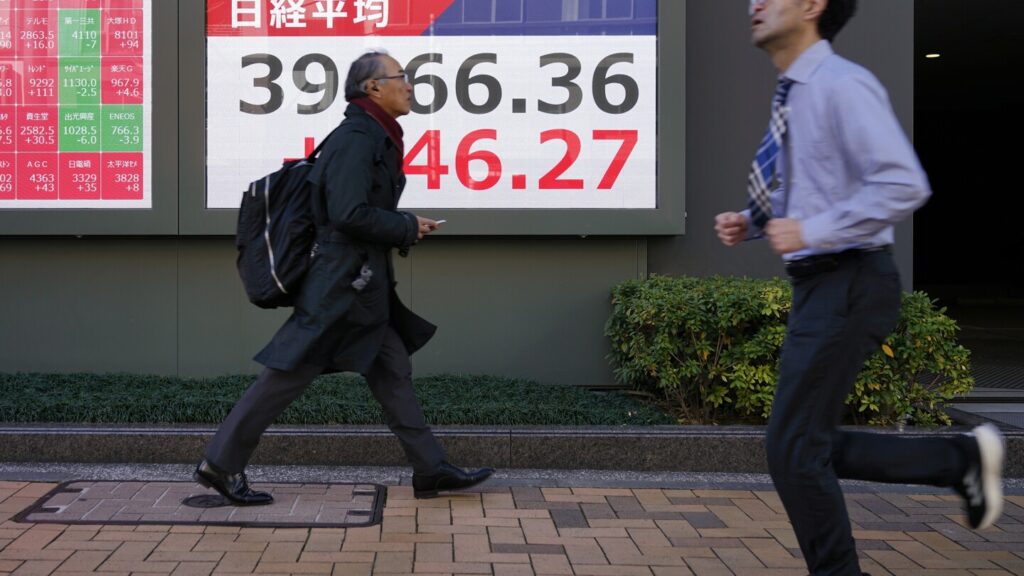

Asian shares surged on Tuesday following President Donald Trump’s announcement of a one-month delay in tariffs on Mexico and Canada. The positive news propelled stocks across Asia, with Hong Kong’s Hang Seng Index rising by 2.10%, Japan’s Nikkei 225 by 1.61%, South Korea’s Kospi by 1.63%, and Australia’s S&P/ASX 200 by 0.13%.

Furthermore, Trump’s plan to hold talks with Chinese President Xi Jinping raised hopes of a potential trade deal, easing concerns of a broader trade conflict. The postponement of tariffs on Canada and Mexico provided immediate relief to market sentiments, as indicated by market strategist Yeap Jun Rong.

The delay in tariffs signals Trump’s willingness to negotiate and potentially use tariff adjustments as bargaining tools, rather than fixed policy decisions. In response to these developments, U.S. stocks experienced fluctuations, with the S&P 500 falling by 0.8% and the Dow Jones Industrial Average and Nasdaq composite also registering declines.

In the energy sector, benchmark U.S. crude and Brent crude saw slight decreases in prices. Currency trading reflected a minor uptick in the U.S. dollar against the Japanese yen and a slight drop against the euro.

Overall, the market’s positive response to the tariff postponement highlights the importance of ongoing trade negotiations and their impact on global economic stability.