In a strategic move, Japan-based Nippon Steel’s investment in U.S. Steel under a “golden share” arrangement has granted President Donald Trump significant influence over the operations of the iconic American steelmaker. The $11 billion plan for new investments by 2028, approved as a national security agreement, signifies a partnership between the two companies, despite Nippon Steel’s initial intent to fully acquire U.S. Steel. The government’s terms empower Trump to veto major decisions such as relocation, renaming, job transfers, or factory closures, ensuring a focus on domestic production and job security.

Commerce Secretary Howard Lutnick detailed the extensive powers of the “golden share,” emphasizing its protection of American interests and steelworkers. The deal, valued at potentially $28 billion with plans for a modern steel mill, highlights the government’s active role in safeguarding national security and economic stability. While the full terms remain undisclosed, the agreement’s implications on U.S. Steel’s ownership structure have raised concerns among stakeholders, including the United Steelworkers union.

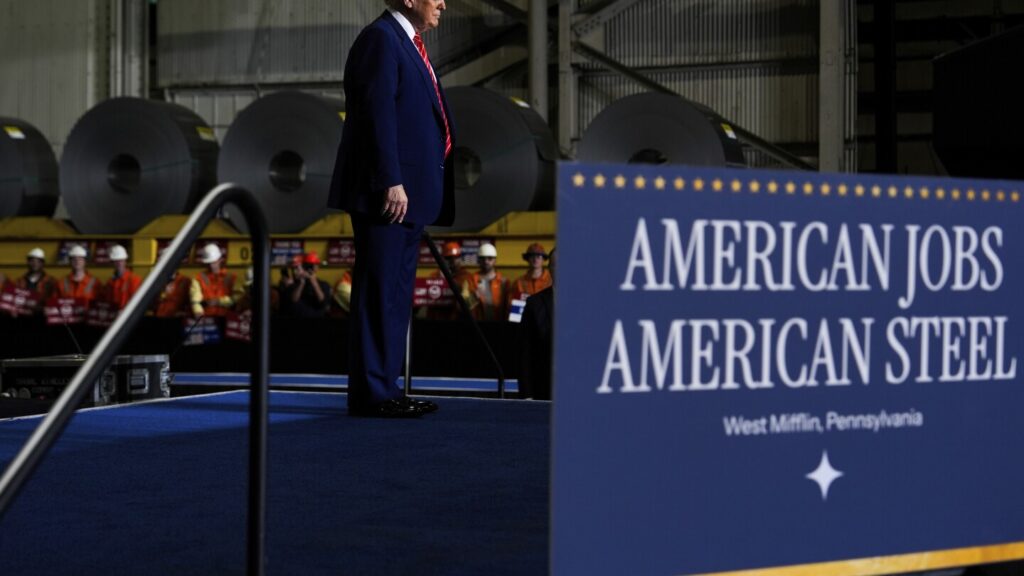

Trump’s involvement in negotiating labor agreements amidst the upcoming midterm elections adds a complex dimension to the situation, especially considering his initial opposition to Nippon Steel’s acquisition during his presidential campaign. The evolution of the deal under both the Biden and Trump administrations underscores the delicate balance between foreign investments, national security, and domestic manufacturing interests. Nippon Steel’s commitments to U.S. Steel’s growth and operational integrity reflect a concerted effort to address American officials’ concerns and ensure a mutually beneficial outcome in the steel industry landscape.