Elon Musk’s Tesla has seen a remarkable surge in stock market value following the presidential election, defying market norms with its upward trajectory despite a recent underwhelming financial report. Investors are optimistic about the potential benefits of President Trump’s regulatory rollbacks and trade policies on Tesla’s future. Musk’s ambitious plans for Tesla, including the introduction of robotaxis and driverless vehicles, are seen as key drivers of the company’s growth. Trump’s administration, particularly through Transportation Secretary Sean Duffy, is expected to ease regulations on automakers and streamline self-driving technology standards, benefiting Tesla.

However, potential challenges lie ahead for Tesla due to Trump’s tariffs on key markets like China, Canada, and Mexico, impacting the company’s global supply chain. Furthermore, regulatory scrutiny, especially regarding Tesla’s Full Self-Driving technology, poses a risk to the company’s operations. Despite recent setbacks in sales and financial performance, Tesla’s stock continues to soar, reflecting investors’ confidence in Musk’s vision and Trump’s potential support.

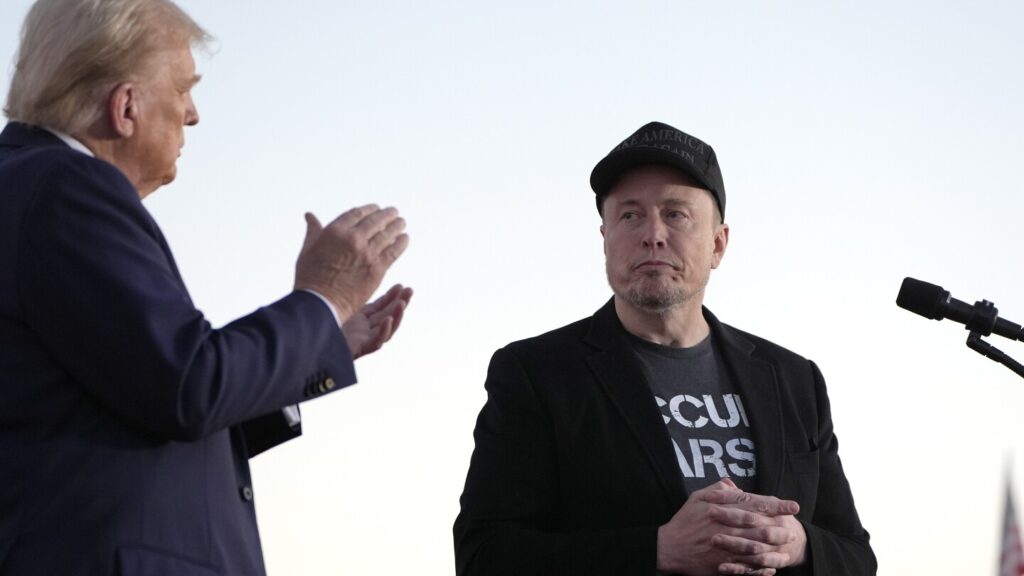

Musk’s foray into politics, including controversial statements and gestures, has stirred controversy and raised concerns about potential customer alienation and regulatory backlash in Europe. Nevertheless, Musk remains bullish on Tesla’s prospects, aiming for the company to become the most valuable in the world. Analysts foresee further growth for Tesla, attributing much of its potential success to the anticipated deregulation under Trump’s administration. The unprecedented bet on Trump’s policies by Musk underscores the unique dynamics shaping Tesla’s future in the rapidly evolving automotive industry.