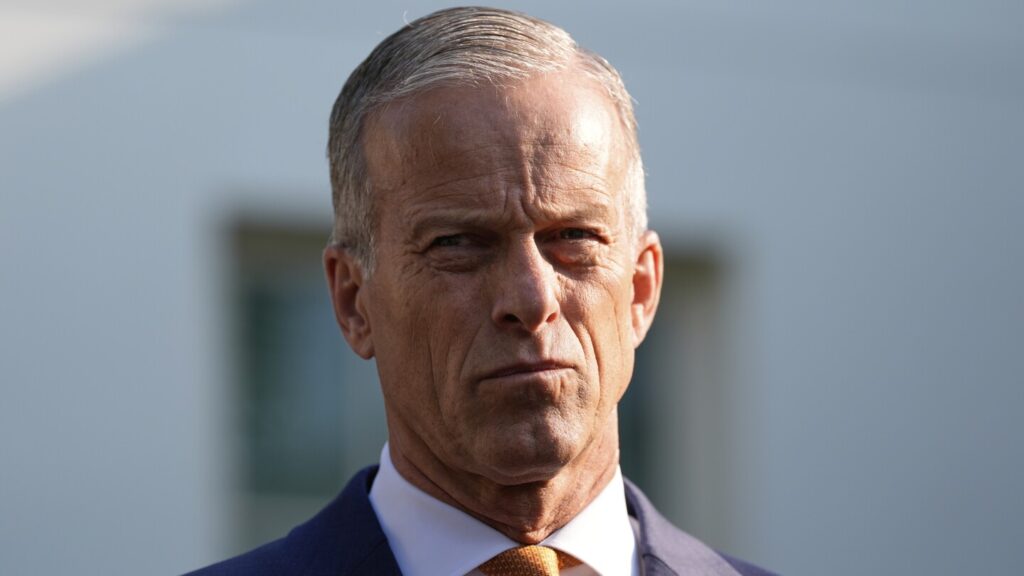

The Senate is working on passing President Trump’s ambitious tax and spending legislation by July 4, facing challenges such as Medicaid cuts and deficit impacts. Senate Majority Leader John Thune must navigate concerns from rural state lawmakers, who fear devastating effects on Medicaid and rural hospitals. Providers’ taxes are a key issue, with Sen. Hawley warning of hospital closures if these are frozen. Meanwhile, Senate Republicans oppose the House’s provision on state and local tax deductions, favoring adjustments.

Former governors in the Senate, like Sen. Jim Justice of West Virginia, are wary of shifting Medicaid and food stamp costs to states. Concerns arise over higher state shares for SNAP benefits and administrative costs. Moderates like Sens. Collins and Murkowski are cautious about Medicaid cuts and SNAP changes. Energy tax credits face scrutiny from some senators due to potential business uncertainty.

On the right flank, Sens. Paul, Johnson, Lee, and Scott argue that the legislation doesn’t save enough money. Paul specifically opposes raising the debt ceiling and demands more spending cuts. Despite differing views, there is recognition of the bill’s positive aspects and the need to find common ground to advance the legislation successfully. The Senate faces a complex task of addressing various concerns and priorities to move President Trump’s bill towards passage.